Best Health Insurance for Foreigners in Singapore:

Singapore has one of the best public health systems in the world. As a result, the people who live there enjoy excellent health. Singapore performs admirably in almost every category. The country ranked sixth in the World Health Organization’s ranking of the world’s health systems in 2000, a position it has maintained to this day.

Table of Contents

The Economist Intelligence Unit ranked Singapore second among 166 countries in terms of health-care outcomes. Singapore was ranked fourth healthiest in the world in the Bloomberg Global Health Index, which included 163 countries. In 2019, Singaporeans had the world’s longest life expectancy of 84.8 years. No wonder Singapore is popular among expats and digital nomads! Here’s what foreigners need to know about health insurance in Singapore before they move.

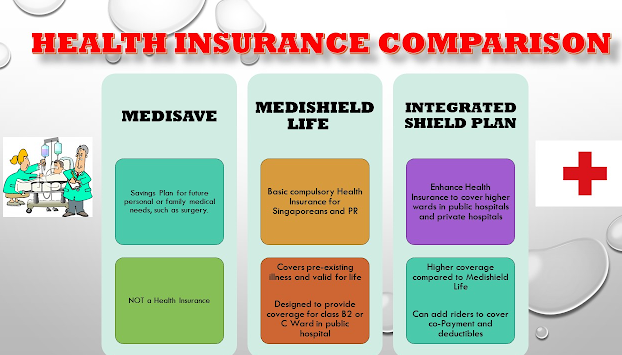

Singapore’s national health insurance system is MediShield Life.

Singapore provides universal healthcare through public and private facilities. Singapore citizens and permanent residents (PRs) are eligible for subsidized government healthcare services. This is because they contribute to the national mandatory savings program. To receive subsidized healthcare, all citizens and permanent residents must subscribe to an approved health insurance or medical care plan known as Medishield Life.

Medishield Life covers a large portion of hospital and outpatient expenses. In general, Medishield Life policies have a deductible plan. Patients must either pay a minimum amount before making a claim, or pay a percentage of the medical fees while the insurer pays the rest. This public healthcare is provided by government-run “polyclinics” There are also hospitals. In addition, the government provides grants and other subsidies, such as the CHAS card, which provides subsidized medical treatment, to those who cannot afford premiums and co-payments.

Pros and Cons of Using Singapore’s Local Healthcare System

Foreigners are not eligible for Medishield Life. , However, because they are exempt from paying, they are unable to obtain government-subsidized health insurance and related services. If they went to a public hospital, they would have to pay for it.

In general, the cost of a routine medical appointment is reasonable. Physicians at public hospitals speak English, have received extensive training, and provide excellent care. However, medical and healthcare costs can quickly escalate if you require diagnostic tests, specialist consultations, or surgical procedures. In turn, Singapore’s private hospitals have shorter wait times and more comfortable, private facilities.

How Expats in Singapore Obtain Health Insurance

In short, they cannot. In Singapore, only citizens and permanent residents (PRs) are eligible for public healthcare. The term “permanent resident” has a different meaning in Singapore than in Europe, where permanent residency is relatively easy to obtain. Singapore PRs have a very specific status that can only be obtained after years of residency and an application to the Ministry of Manpower.

Most expats in Singapore are not permanent residents, and they never will be. They are people who have visas such as the employment pass, dependent pass, and S-pass. As a result, they are unable to contribute to the Central Provident Fund (CPF), which funds public healthcare.

Benefits of Global Medical Insurance Plans

Medishield is just the tip of the iceberg in terms of insurance options available to Singaporeans and PRs. A large proportion of people also have private healthcare insurance, which can cover long-term care needs, disability care and income needs, critical illness expenses, and even lost wages while hospitalized.

Foreigners, on the other hand, do not benefit from this. It is their responsibility to seek private insurance. This is frequently covered by employers, or it can be purchased from private insurers prior to moving abroad. The standard of living in Singapore is very high, but so is the cost of living. It is a good idea to protect yourself from unexpected medical expenses caused by a loss of health.