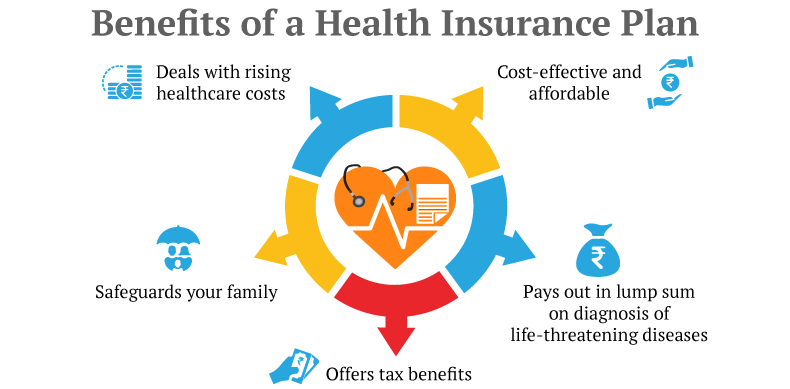

Best Health insurance plans and policies:

We did this based on our subjective assessment, and we believe these are the best health insurance companies in India in 2024.

In India, there are 31 health insurance companies that offer over 100 different health insurance policies. So choosing the best health insurance plans can be difficult.

Table of Contents

This is why we’ve compiled this list to help you choose the best health insurance policies in India for 2024.

Our Methodology for Health insurance plans

If you’re new to insurance, we highly recommend reading our Health Insurance Guide for Beginners.

Now, we compiled this list based on two broad criteria.

The first is our assessment of the insurance company marketing a specific policy. Any company can launch a health insurance plan with impressive features on paper. However, if customers have difficulty purchasing the policy, filing a claim, or resolving issues, the product features will be rendered ineffective. Health insurance plans

To rank each health insurance company in India, we considered several operational and financial metrics such as claim settlement numbers, track record, and solvency ratios.

We then compared each product’s features. Keep in mind that most insurance companies will offer a basic, affordable product, a comprehensive product, and a premium product. The basic product doesn’t provide much protection.

Furthermore, premium products are prohibitively expensive and often lack features that add significant value to the majority of people. So, while compiling this list, we only considered comprehensive products that provide significant protection without burning a hole in your pocket. Health insurance plans

Best Health Insurance Plans.

HDFC Ergo Optima Secure Health Insurance.

This year’s top performer is HDFC Ergo Optima Secure. It was launched to replace the company’s best-selling product, Optima Restore. In just two years since its launch, it has exceeded all expectations and emerged as our top recommendation for the best health insurance plan for 2024.

Why is Optima Secure our top recommendation?

Optima Secure is a very comprehensive policy. It has no room rent restrictions or co-pay clauses, covers Ayush treatments, and has reasonable waiting periods for pre-existing conditions. It also includes a slew of industry-first features that will excite many people.

The Secure Benefit:

instantly doubles your coverage the moment you purchase the policy. For example, if you purchase a policy with a sum insured of ₹10 lakhs, you will receive ₹10 lakhs as base coverage and an additional ₹10 lakhs as “Secure” benefits. Essentially, you get double the coverage without having to pay more.

Protect Benefit:

Most insurers do not cover non-medical expenses such as bandages, syringes, gloves, and masks. Even if they do cover it, they expect you to pay more. However, Optima Secure covers these expenses at no additional cost.

Plus Benefits:

Most insurance companies will offer you a bonus if you do not file a claim in any given year. However, Optima Secure has completely redesigned the bonus feature and now provides 50% bonus cover every year, regardless of whether you make a claim. If you renew your policy for two consecutive years, you could receive a bonus of up to 100%.

Care Supreme Health Insurance

Care Supreme ranks second on our list because it is now the best-selling health insurance policy in Care’s portfolio. The company launched this plan to compete with HDFC Ergo’s Optima Secure and Niva Bupa’s Reassure. And, given the features included and the price point at which it is sold, Care Supreme could be a very appealing option for many people.

Why is Shikhar Dhawan not giving chance to this foreign player, what is reason, know full news

Niva-Bupa Reassure 2.0 Health Insurance

Reassure 2.0 is third on our list and is the long-awaited successor to one of Niva Bupa’s most popular insurance plans in recent years, Reassure. Furthermore, Reassure 2.0 builds on the success of Reassure by providing three variants of the same plan with extremely comprehensive features at very competitive prices. For the purposes of this list, we are considering the Platinum variant of Reassure 2.0, which falls between the Bronze and Titanium variants.